Q&A for EB-5 Visas

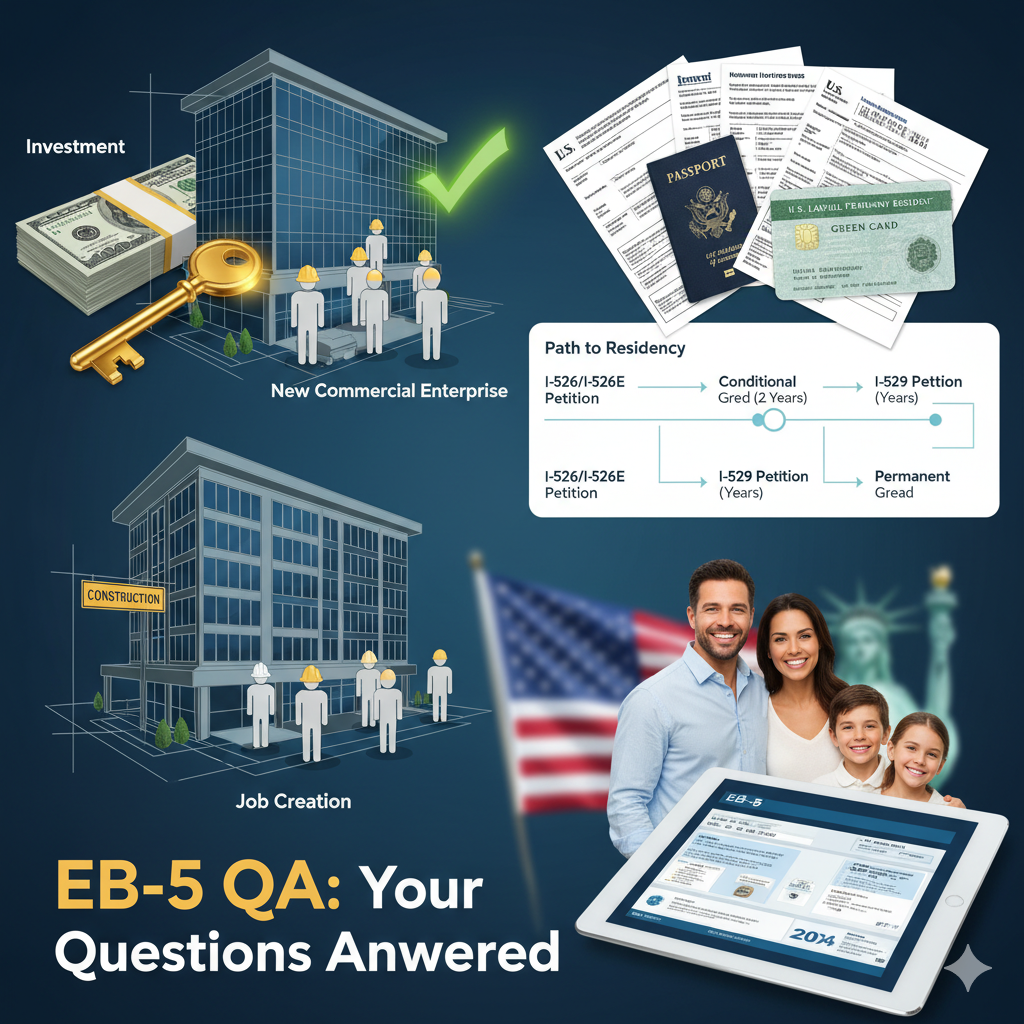

EB-5 Visa, also known as the Immigrant Investor Program, allows foreign investors to obtain a U.S. green card by investing in a U.S. commercial enterprise.

- Introduced in 1990 to boost U.S. economic growth

- Requires a qualifying capital investment

- Includes spouse and unmarried children under 21

- Initial green card is conditional for 2 years

The standard EB-5 investment is $1,050,000. If the investment is made in a Targeted Employment Area (TEA), the minimum is $800,000.

Investment Amounts

- Before March 15, 2022: $1,000,000 (TEA: $500,000)

- On or After March 15, 2022: $1,050,000 (TEA: $800,000)

| Filing Date | Standard | TEA |

|---|---|---|

| Before 3/15/2022 | $1,000,000 | $500,000 |

| On or After 3/15/2022 | $1,050,000 | $800,000 |

Source: USCIS Policy Manual

The investment must be made in a for-profit U.S. business formed to conduct lawful commercial activity.

- Located in the U.S. or its territories

- Can be a corporation, partnership, or sole proprietorship

- Must create at least 10 full-time jobs

Each EB-5 investment must create 10 full-time jobs for qualifying U.S. workers within two years.

The investor must be involved in management or policy-making, either directly or through a governing role.

What is the At-Risk Requirement?

The EB-5 investment must be subject to both gain and loss. Guaranteed returns are not permitted.

- Funds must be used for business operations

- No collateral guarantees allowed

- Lawful source of funds documentation required

Regional Centers are USCIS-approved entities that pool EB-5 investments to promote economic development.

Direct Investment

- Investor manages the business

- Only direct jobs count

- Greater control and responsibility

Regional Center Investment

- Passive investment model

- Direct + indirect jobs allowed

- Managed by approved regional center

EB-5 investors receive a 2-year conditional green card. To remove conditions, Form I-829 must be filed.

- I-526 / I-526E – Investor Petition

- I-485 – Adjustment of Status

- I-829 – Remove Conditions

- I-924 / I-924A – Regional Center filings

- G-28 – Attorney Representation

Somireddy Law Group PLLC provides end-to-end EB-5 guidance including source-of-funds strategy.

📧 info@somireddylaw.com

Write a Comment